German 'hypocrisy' over Greek military spending has critics up in arms

Athens' fondness for weaponry, and willingness of Germany and France to feed it, under fire as Greece struggles with debt crisis

Akis Tsochadzopoulos

A few months before submarines became the talk of Athens, Yiannis Panagopoulos, who heads the Greek trade union confederation (GSEE), found himself sitting opposite Angela Merkel at a private meeting the German chancellor had called of European trade unionists in Berlin.

When it came to his turn to address the leader, he instinctively popped the question that many in Greece have wanted to ask. "After running through all the reasons why austerity wasn't working in my country I brought up the issue of defence expenditure. Was it right, I asked, that our government makes so many weapons purchases from Germany when it obviously couldn't afford such deals and was slashing wages and pensions?"

Merkel's reaction was instant. "She immediately said: 'But we never asked you to spend so much of your GDP on defence,'" Panagopoulos recalled. "And then she mentioned the issue of outstanding payments on submarines she said Germany had been owed for over a decade."

Greek profligacy may be blamed for triggering the debt crisis that now threatens to tear the eurozone apart, but if there is one area where Berlin is less excoriating of state largesse it is in Athens's extravagant taste for arms.

Behind the frequent exhortations that Greece rein in spending after living "beyond its means" – admonishments made most loudly by Merkel and her finance minister Wolfgang Schäuble – there is another reality that paints Germany in a less than flattering light, according to MPs, military experts, economists and scholars.

"If there is one country that has benefited from the huge amounts Greece spends on defence it is Germany," said Dimitris Papadimoulis, an MP with the Coalition of the Radical Left party.

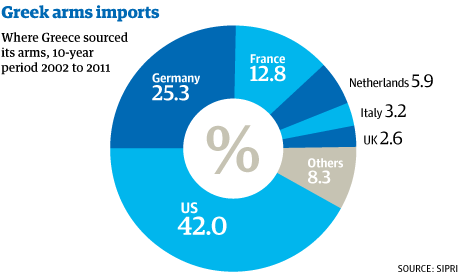

Greek arms imports

"Just under 15% of Germany's total arms exports are made to Greece, its biggest market in Europe," Papadimoulis said, reeling off figures from a scruffy armchair in his party's parliamentary office. "Greece has paid over €2bn (£1.6bn) for submarines that proved to be faulty and which it doesn't even need.

"It owes another €1bn as part of the deal. That's three times the amount Athens was asked to make in additional pension cuts to secure its latest EU aid package."

According to the Stockholm International Peace Research Institute (Sipri), France is not far behind. Some 10% of its total arms sales go to Greece, which is a member of Nato. From 2002 to 2006, Greece was the world's fourth biggest importer of conventional weapons. It is now the 10th.

"As a proportion of GDP, Greece spends twice as much as any other EU member on defence," said Papadimoulis, who is also a former MEP.

"Well after the economic crisis had begun, Germany and France were trying to seal lucrative weapons deals even as they were pushing us to make deep cuts in areas like health."

Under the latest EU-IMF-sponsored rescue programme – which is propping up the near-bankrupt Greek economy with an extra €130bn in emergency loans until 2015 – Athens has agreed to cut defence expenditure by €400m. Even so, its military budget accounts for nearly 4% of national economic output, compared with the eurozone average of around 2%. The country has cited perceived security risks from Turkey and, in addition to state-of-the-art submarines, has bought hundreds of Leopard tanks, howitzers, Mirage fighter planes and F-16 jets from Germany, France and the US since the late 1990s.

Speculation is rife that international aid was dependent on Greece following through on agreements to buy military hardware from Germany and France.

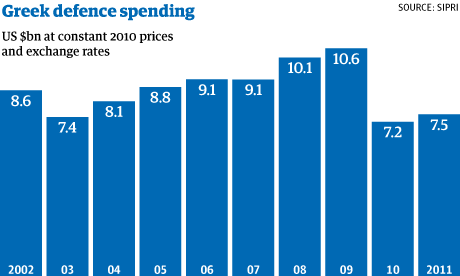

Greek defence spending

"Since the 1974 Turkish invasion of Cyprus, Greece has spent an estimated €216bn on armaments, although I am 100% certain that in absolute terms its defence expenditure is much greater than official documents would show due to the so-called secret funds the state has access to," said Katerina Tsoukala, a Brussels-based security expert.

"The problem is that unlike Britain, for example, Greece has never had a transparent and democratic defence procurement strategy. Instead, everything is veiled in secrecy and people like me have to go to Sipri to find out information that in other countries would be readily available."

The murkiness has ensured that over the years the Greek arms trade has become increasingly associated with high-level bribery and corruption – the very practices abhorred by Berlin, Athens' main provider of rescue funds.

This week the former defence minister Akis Tsochadzopoulos was jailed pending trial on charges of accepting an €8m bribe from Ferrostaal, the German company that helped oversee the scandal-marred sale of four Class 214 submarines to the Greek navy 12 years ago. To date, Athens has taken delivery of only one of the subs after the vessels were found to have technical glitches.

Tsochadzopoulos, the most senior official yet to be arraigned in connection with corruption, stands accused of funnelling the cash, initially deposited in a Swiss bank account, via offshore companies to buy two properties in Athens, including a luxury home on the capital's most expensive boulevard. His wife and daughter also appeared in court on Thursday accused of money laundering. They, along with the veteran socialist, denied the charges.

In the course of a two-year investigation by prosecutors in Munich, senior Ferrostaal employees, including its chief executive, resigned after acknowledging that money had been exchanged to secure the sale of submarines to Greece and Portugal.

Last year, after publicly apologising for its role in the furore, Ferrostaal agreed to pay a €140m fine.

In a similar case the German engineering group Siemens recently reached an out of court settlement with Greece following claims it had bribed cabinet ministers and other officials to secure contracts before the 2004 Olympic Games in Athens. Tassos Mandelis, a former socialist transport minister, admitted he had accepted a €100,000 payment from Siemens in 1998.

The settlement has paved the way for the company to bid for public procurement tenders in Greece, but it has also highlighted the unsavoury business practices of leading German firms. "There's a level of hypocrisy here that is hard to miss," said Papadimoulis. "Corruption in Greece is frequently singled out as a cause for waste but at the same time companies like Ferrostaal and Siemens are pioneers in the practice. A big part of our defence spending is bound up with bribes, black money that funds the [mainstream] political class in a nation where governments have got away with it by long playing on peoples' fears."

At the time of the settlement, Siemens said it was "committed to ensure, going forward, full and overall compliance to sound corporate principles".

Given Greece's financial predicament – illustrated last week by IMF managing director Christine Lagarde's refusal to rule out a default – growing numbers have begun to question the probity of the nation's defence expenditure.

Deputy prime minister Theodore Pangalos publicly rued the fact that Athens was spending so much money on arms, exclaiming during a visit by the Turkish prime minister, Recep Tayyip Erdogan, that Greece was being "forced to buy weapons we do not need".

No other area has contributed as heavily to the country's debt mountain. If Athens had cut defence spending to levels similar to other EU states over the past decade, economists claim it would have saved around €150bn – more than its last bailout. Instead, Greece dedicates up to €7bn a year to military expenditure – down from a high of €10bn in 2009.

"Germany became Germany partly because for 62 years it did not have to think about military expenditure," said Angelos Philippides, a prominent economist. "For a long time Greece spent 7% of its GDP on defence when other European countries spent an average 2.2%. If you were to add up that compound 5% from 1946 to today, there would be no debt at all," he said. "It's vital that if the European Union wants to speak about fair deals it should at least guarantee Greek borders [with Turkey] so the country can bring down military spending to 2.2%."

The imbalance has spawned speculation that peripheral countries in Europe with vulnerable frontiers such as Greece are being exploited in terms of defence spending by wealthier states at Europe's core.

Thanos Dokos, a leading Greek defence expert, says rational debate on such military extravagance has been made impossible by the supposed Turkish threat and a fear among politicians of being labelled unpatriotic.

"One could argue that with 1,300 tanks, more than twice the number in the UK, Greece has many more than it needs. But no one forced it to spend so much. It happened because of the threat perception from Turkey and the need to balance Turkey militarily," he said.

He said there was an element of hypocrisy in the criticism being levelled at Greece in France and Germany.

"Knowing the economic situation of the country, and all the talk about Greece's overspending for the last 20 years, one feels like saying 'hold off, gentlemen, with the criticism'," he said. "It's hypocritical to ignore the fact that a not insignificant amount was spent on buying weapons systems from EU members Germany and France."

Guardian