O seguinte artigo é interessante na medida em que fornece um exemplo concreto de quão bom é o mercado de acções ou o mercado imobiliário para proteger o poder de compra [

em ambos as pessoas perderem cerca de 30% do poder de compra] numa crise.

Learning from Argentina

by Josep Bayarri

7 Aug 2012

http://observationsofafrustratedassetmanager.blogspot.pt/2012/08/learning-from-argentina.htmlIntroductionWe are living in uncertain times. There has been talk of the euro disappearing—or at least of some peripheral European countries abandoning it in favor of their old pesetas, dracmas, etc—and people have started withdrawing their savings from their bank accounts. Some people are moving their money abroad, some are keeping it stashed at home, and some are even buying foreign currencies to protect themselves from the possibility of a financial Armageddon. Whenever somebody talks about the future of the euro, the word “

corralito” comes to mind, as people still remember the lines of people waiting to withdraw their savings from Argentinean banks at the end of 2001. But if we can remember the panic in Argentina, we can also learn from what happened then.

Here, I will start with a timeline of the events in Argentina from 2001 to the end of 2002, and will follow this with an analysis of the effects on both the real estate market and the equity market.

Chronology of events

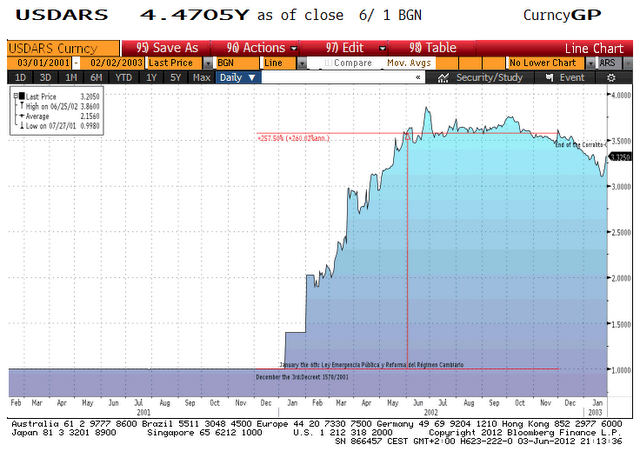

Evolution of USD/ARS exchange rate

: Deposits in Argentina amount to USD 85 billion.

March, 2001: Start of the deposit run: USD 5 billion had already left the country.

June, 2001: Due to the overwhelming weight of public debt, the government of Argentina asks the IMF for help, and agrees to proceed with the “megacanje,” an operation that consisted of delaying the maturity of $29.5 billion in bonds set to mature between 2001 and 2005 to instead mature between 2006 and 2031, in exchange for higher coupons and the application of adjustments on Argentina’s economy.

July, 2001:

Law 25,453 of ‘Zero deficit’August, 2001:

Law 25,466 of “Intangibilidad de los depósitos”. Its main articles are the following:| | SECTION 1 - All deposits, whether in pesos or foreign currency, in fixed term or current account, captured by financial institutions authorized to operate by the Central Bank of Argentina, in accordance with the provisions of Law 21,526 and its amendments, are included in the scheme of this Act. These deposits are considered intangible.

SECTION 2 - The intangibility established in Article 1 means: the government, under any circumstances, can not alter the conditions agreed between the depositors and the financial institution, which means the prohibition of exchanging them for securities of the public debt, or other national government asset, or extend the payment thereof, or alter the agreed rates or currency of origin, or restructure the maturities, which will operate on the specified dates agreed between the parties. |

November, 2001: Total deposits amount USD 67 billion.

December 3, 2001: The “corralito” begins. In order to stop the deposit run and speculation over the deposit convertibility of pesos to dollars, the Argentinean government approves the Decree 1570/2001:

| | Prohibitions for financial institutions

- Cannot perform active operations denominated in pesos, or operate in the markets of futures and option on foreign currency, or directly or indirectly hedge with forward operations in pesos. Existing operations may be converted into U.S. Dollars at the Exchange rate provided in the Convertibility Law No. 23,928, with the consent of the debtor.

- They will not offer higher interest rates on deposits denominated in pesos, compared to those offered on deposits denominated in U.S. Dollars. Existing operations may be converted into foreign currency, at the request of the owners, at the Exchange rate established under the Convertibility Law No. 23,928.

- When proceeding to any transaction, deposit, payment, transfer, they will not charge any commission for the conversion of pesos into US dollars at the exchange rate established in the Convertibility Law No. 23,928. Neither in transactions converting US dollars to pesos, provided that any such transactions are entered through accounts with financial institutions.

Prohibitions for the population

- Cash withdrawals exceeding two hundred fifty pesos ($ 250) or two hundred fifty U.S. Dollars ($ 250) per week for the owner, or owners acting jointly or severally, of the sum of all their accounts in each financial institution.

- Transfers abroad, except those corresponding to foreign trade, payment of expenses or withdrawals made abroad through credit cards or debit cards issued in the country, or the cancellation of financial transactions, or other concepts if authorized by the Central Bank of Argentina.

|

December, 2001: Argentina defaults.

January, 2002: Start of the “

corralón”

| | On January 6, 2002, the Duhalde government promulgated the “Ley de Emergencia Pública y Reforma del Régimen Cambiario” (Law on Public Emergency and Exchange System Reform) repealing convertibility and proceeding to the “pesificación” (conversion to pesos) of all credits extended by the financial system. On January 9, 2002, the government issued Decree 71/2002 laying down the new official exchange rate at 1.40 pesos per U.S. dollar. Furthermore, the decree regulates the de-dollarization of debts of natural and legal persons according to an Exchange rate of 1 peso = 1 U.S. dollar, keeping the other conditions as originally agreed upon.

The corralito did not deteriorate the assets of Argentinean depositors maintaining its value (1 peso = 1 dollar). The corralón, however, did, breaking the law cited above 25,466. Years later, the Supreme Court would support this measure.

Subsequently, on February 6, the government promulgated Decree No. 214/2002 called “Reorganización del Sistema Financiero” (Reorganization of the Financial System) which provided:

- From the date of this Decree, all payable obligations of money in U.S. dollars or other foreign currencies are converted into pesos.

- All deposits in U.S. dollars or other foreign currencies existing in the financial system, will be converted into pesos at a rate of one peso and forty cents ($ 1.40) per U.S. dollar, or its equivalent in other foreign currency. The financial institution will fulfill its obligation by returning pesos at the indicated rate.

- All debts in U.S. dollars or other foreign currencies and the financial system, whatever its amount or nature, will be converted into pesos at a rate of one peso per U.S. dollar or its equivalent in other foreign currency. The debtor will fulfill its obligation by returning pesos at the indicated rate.

Thus establishing the so-called “asymmetric pesification” in which debts to the financial system were converted into pesos at a rate of one peso per dollar, but foreign currency deposits were recognized by financial institutions at $ 1.40 = U.S. $ 1. The difference was recognized by the national government with a bond that was given to banks to compensate for this “asymmetry.” |

December 2, 2002: End of the

corralito-corralón. One US Dollar = 3,575 Argentinian Peso (ARS)

Effects on the Real Estate MarketIn “

The Response of Various Real Estate Assets to Devaluation in Argentina,” by Ricardo Ulivi, José Rozados, and Germán Gómez Picasso, published in the Journal of American Academy of Business, Cambridge in 2005, which can be accessed through

Reporte Inmobiliario’s website, the authors analyzed the evolution of the three main segments of the real estate market near Buenos Aires, arriving at the following conclusion:

“

After the first three months of 2002, during which the real estate business market was practically paralyzed, the behavior of the different real estate sub-markets was different. The “industrial” market suffered the most important change of values after devaluation of the Argentine currency, with prices dropping 67% during the first year. Next was the “office” market depreciating 53% during the same period. The residential “apartment” market value dropped only 29% during the first year after devaluation.”

Before the Argentinean government stopped the convertibility of pesos into U.S. dollars, prices of real estate assets had been falling because people had been trying to sell their properties in order to get cash to protect themselves from the expected currency devaluation.

After the

corralito, the residential segment had the best performance: in the first stage it lost only 29% of its value in U.S. dollars, and since then it hasn’t stopped growing. Its behavior has been similar to that of “tradable goods,” those assets susceptible to export, while prices of the offices and industry segment have been more similar to non-tradable goods: those for domestic consumption, which dropped following the devaluation of the peso against the U.S. dollar.

Since pesos lost approximately 70% of their value against the U.S. dollar, we can say that the residential real estate sector was an “acceptable” hedge against the devaluation of the peso.

Effects on the Equity MarketThe start of the

corralito in December 2001 was closely followed by an equity rally as people tried to escape the loss of value of their savings by investing in the most liquid stocks. As Eduardo Levy Yeyati, Sergio L. Schmukler, and Neeltje Van Horen analyze in their article, “The Price of inconvertible deposits: the stock market boom during the Argentine crisis,” the main factors behind this boom were: stock prices were quoted in pesos, they were not affected by the

corralito laws, and they protected investors from a loss of value in their money.

In the following graph we can see that in the period in which the

corralito was operational, the Argentinean main equity index, MERVAL, returned 140.8%, valued in local currency. However, if we take into account the loss of value of pesos in the same period—around 70%—we can see that the performance of MERVAL from December 3, 2001, to December 2, 2002, was, in U.S. dollars, -32%. This negative performance was similar to that of the real estate market’s residential sector, thus providing an acceptable -though not perfect- hedge against the devaluation of the Argentinean peso (ARS).

Evolution of MERVAL index in USD (red) and ARS (black)

In the same article, the authors found that the performance of American Depositary Receipts (ADRs) was not significantly different to the rest of the stock market. This explains how the MERVAL index was used as a way to get exposure to the U.S. dollars instead of a way to transfer money abroad: ADRs stocks gave investors the option to exchange money to U.S. dollars in international financial centers like New York, but capital controls established by the Argentinian government were not circumvented.

On the other hand, a simple analysis of the behavior of the MERVAL index members at that time shows how the behavior of every company was different depending on their exposure to those desired “foreign dollars.” Obviously, local banks had the greatest exposure to the local economy and were the main victims of “asymetric pesification,” and hence suffered the most: Banco Suquía (BSUQ AR) filed for bankruptcy on September 20, 2002, and Banamex (Citigroup Inc.’s Mexican subsidiary) sold its 59% stake in Bansud for USD 65 million to Banco Macro SA at the very beginning of the

corralito. The rest of the banking sector clearly underperformed the index, with the sole exception of Banco Santander, a Spanish bank trading on the Buenos Aires stock exchange and a member of the MERVAL index. Among the underperformers we can also find companies in the utilities sector, such as Transportadora de Gas Sur (TGSU2 AR), Telecom Argentina SA (TECO2 AR), and Central Puerto SA (CEPU2 AR).

But matching the index, or even outperforming it, was not enough to keep investors protected from the peso’s loss in value: only the top 9 performers of the MERVAL index managed to keep investors fully covered. The best performers were mainly companies in the basic materials sector, such as Solvay Indupa (INDU AR), which produces and markets petrochemicals, and Atanor (ATAN AR), which manufactures chemicals, petrochemicals and agrochemicals. Endesa Costanera SA (CECO2 AR), Sociedad Comerial del Plata (COME AR), Siderar (ERAR AR), Acindar Ind. Argentina (ACIN AR), Siderca SAIC (ERCA AR) and Molinos Río de la Plata (MOLI AR) were the remaining companies that came out of the

corralito with a stock market price—in U.S. dollars—above their initial price.

In the following table, I have marked in green the stocks with a positive return in U.S. dollars in the period:

ConclusionsFrom this analysis, we can conclude that the broad equity market (MERVAL index) and the real estate market were effective to a similar degree at the time to get protection from the Argentinian Peso devaluation. In both cases, these investments would have saved approximately 70% of the value of a model portfolio. An accurate selection of equity investments—focusing on sectors with significant inflows of U.S. dollars—would have protected your entire portfolio and allow an investor to benefit from this situation. We can also assume that the behavior of the real estate sector was not homogeneous, but unfortunately we don’t have more precise information on the performance of sub-segments in the residential sector that would allow a more accurate analysis.