TIC…TIC…TIC: The Ominous Warning in Foreigners’ U.S. Bond Positionsby ffwiley

on April 11, 2013

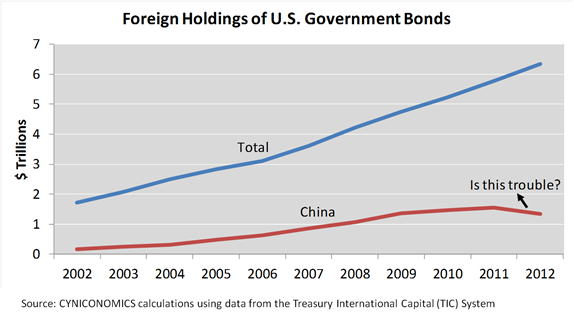

http://www.cyniconomics.com/2013/04/11/tictictic-the-ominous-warning-in-foreigners-u-s-bond-positions/When data released last year showed China losing its appetite for U.S. bonds, it didn’t cause much concern. Sure, some bloggers took notice, such as the always alert Tyler Durden(s) in this

post. But most pundits saw other countries picking up the slack and decided to “move along, nothing to see here.”

As of later this month, we’ll receive the final picture on China’s U.S. bond sales over late 2011 and early 2012, and the reaction isn’t likely to be much different than it was last year. But I’ll argue that there’s actually quite a lot to see. Namely, there’s a brand new reason to be concerned about America’s access to foreign capital.

Comparing annual and monthly TIC dataI’ll first share data from the Treasury International Capital (TIC) System’s annual survey of foreigners’ U.S. bond holdings. Those familiar with the TIC data know that these annual results are notoriously stale. Preliminary data was released on February 28

th, with the final report due April 30

th for a survey describing foreign bond holdings as of June 2012.

In other words, there’s a 10 month lag from survey date to report date.

But the first thing we learned from the preliminary release is that the annual survey didn’t add much information to the approximations published by the Treasury Department on a monthly basis. Thanks to new methods, which were introduced to fix large errors that used to occur in the monthly approximations, revisions were minor this time around.

The February 28

th release merely confirms that China dumped U.S. bonds between the annual survey dates of June 2011 and June 2012, while other countries offset China’s sales by increasing their holdings.

Here’s the comparison of total foreign holdings of U.S. government bonds to China’s holdings:

Now for the bad news

Now for the bad newsAs I mentioned above, most pundits have sounded the all clear based on the continued increase in total foreign holdings. To see the bad news, though, we need to dig deeper. We need to ask who picked up the bonds that China’s no longer buying. And then more importantly, whether those increased purchases are sustainable.

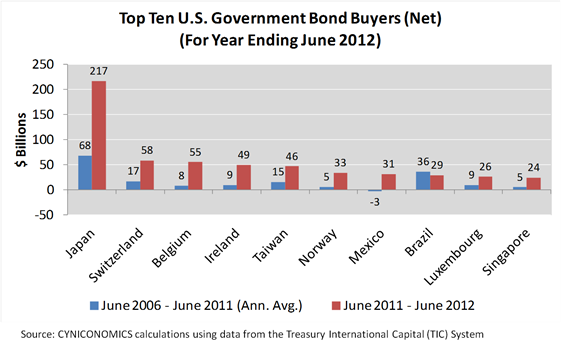

To answer the first question, the chart below shows the top ten buyers of U.S. government bonds in the year ended June 2012, compared to the same countries’ average net purchases in the previous five years.

Japan was the star of the bunch, adding $217 billion to its U.S. government bonds. But it wasn’t the only country to significantly increase its positions. With the sole exception of Brazil, each country in the chart set a new record for the change in U.S. bond holdings in a single year.

Now, moving onto the question of sustainability, we need to collect more information before developing an answer. We need a proxy for each country’s ability to absorb U.S. bonds on a consistent basis. And an excellent choice is the current account balance, which tells us how much foreign currency a country is generating naturally through global trade. It was China’s massive current account surplus, after all, that created the piles of dollars that it was able to recycle into U.S. Treasuries and other global assets in recent decades.

Take the five years from June 2006 to June 2011, for example. On average, China added $183 billion per year to its U.S. government bond holdings over that period. And over roughly the same period (I used calendar years for simplicity), its current account surplus averaged $293 billion per year.

China was spending about 60% of its current account surplus on U.S. government bonds, which seems a manageable amount.

But how about the ten countries in the second chart above? Collecting them into three groups (Japan alone in the first group, then the next four largest bond buyers, and then the five after that), I’ve compared their U.S. government bond purchases to the IMF’s estimates for current account balances in 2012:

Defining unsustainable

Defining unsustainableThese results suggest a whole new challenge in the quest for buyers of U.S. bonds. The old challenge was to sustain the status quo of large current account surpluses and correspondingly large U.S. bond purchases in China. We knew there were limits to the sustainability of these surpluses, but we also knew they can persist for a long time before finally correcting. And after corrections occur, such as in the global trade collapse of 2008/09, imbalances can return.

But today, we’re dealing with a different notion of unsustainable. As long as China was willing to buy huge amounts of U.S. bonds in recent times, it was more than capable of doing so. But you can’t draw the same conclusions for Japan, Switzerland, Belgium and so on. As shown in the chart, investors in these countries spent more than twice their aggregate current account surpluses to buy U.S. bonds in 2011/12. This is much less sustainable than relying on China.

It simply can’t continue for very long.

The results shown above also explain the observation that all but one of the ten countries set new records for net U.S. bond purchases in the latest measurement year. They’ve never bought as many U.S. bonds before 2011/12 because they could only reach these amounts by reallocating assets from other investments, which isn’t something that can be done continually. Again, it’s unsustainable.

In a nutshell, America needs foreigners to be both willing and able to buy its bonds.

China is able but much less willing than it used to be. (Treasury data that isn’t shown here suggests its interest in U.S. securities recovered somewhat in late 2012, but remains far short of the levels of two years ago.)

Other countries are willing but not nearly as able as China, notwithstanding the sharp increase in purchases in the recent period.

And overall, the message in the preliminary TIC data is more worrisome than it may appear on the surface.

Should the final report on April 30

th confirm the message, consider it a warning of a potentially disastrous future decline in foreign purchases of U.S. debt.

(For another perspective on the limits to government borrowing, see “Answering the Most Important Question in Today’s Economy.”)